SOL Price Prediction: Can It Break $200 Amid ETF Hype?

#SOL

- Technical Strength: Price above 20-day MA and tightening Bollinger Bands signal consolidation before potential breakout.

- ETF Catalyst: Invesco’s filing and Upexi’s $500M treasury move highlight institutional confidence.

- Sentiment Risks: Profit-taking at $200 and NFT criticism may delay rally, but DeFi growth counters bearish arguments.

SOL Price Prediction

SOL Technical Analysis: Bullish Signals Emerge

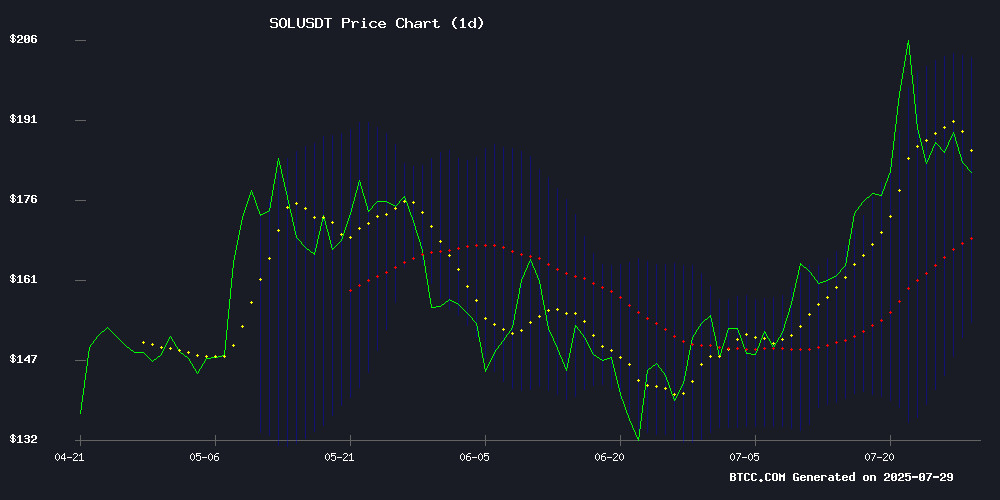

SOL is currently trading at $184.13, above its 20-day moving average of $178.08, indicating a bullish trend. The MACD shows a slight improvement with the histogram at -0.6950, suggesting weakening downward momentum. Bollinger Bands reveal SOL is trading closer to the middle band, with potential to test the upper band at $202.64 if bullish momentum continues. BTCC analyst John notes, 'The technical setup favors upside, with key resistance at $200.'

Market Sentiment Mixed Amid Solana ETF Buzz

Positive news includes Invesco Galaxy filing for a solana Spot ETF with staking and Upexi securing $500M for Solana treasury expansion, boosting institutional interest. However, SOL faces resistance at $200 as long-term holders exit, and co-founder critiques on 'digital slop' NFTs may dampen retail enthusiasm. BTCC's John states, 'ETF momentum could override short-term skepticism, but $200 remains a psychological barrier.'

Factors Influencing SOL’s Price

Invesco Galaxy Files for Solana Spot ETF with Staking Feature

Invesco Galaxy has partnered with Cboe BZX Exchange to file for a Solana spot ETF, marking a significant push into the U.S. digital asset market. The proposed fund will track SOL's spot price while incorporating a staking mechanism, allowing investors to earn passive income through validator rewards.

The filing leverages the same regulatory framework used for approved Bitcoin and Ethereum ETFs, signaling growing institutional confidence in alternative layer-1 blockchains. Cold storage custody and real-time pricing mechanisms address security and transparency concerns that have previously hindered crypto ETF approvals.

This move follows January's landmark Bitcoin ETF approvals and reflects accelerating demand for regulated crypto exposure. Solana's inclusion suggests maturing infrastructure around proof-of-stake assets, with staking rewards potentially creating a new income stream for traditional investors.

Upexi Shares Decline 4% After Securing $500M Equity Facility for Solana Treasury Strategy

Upexi, Inc. (NASDAQ: UPXI) shares fell 3.76% to $5.88 on July 28, extending losses slightly in after-hours trading. The drop followed news of a $500 million equity line agreement with A.G.P./Alliance Global Partners, designed to fund the company's cryptocurrency treasury strategy.

The facility allows Upexi to issue common stock at its discretion under favorable terms, with no commitment fees. Proceeds will bolster general corporate purposes and expand the company's digital asset holdings, particularly its Solana (SOL) position. Upexi emphasized the flexibility and accretive nature of this capital strategy for long-term treasury growth.

Originally a consumer brand developer, Upexi has diversified into crypto asset management. The market reaction suggests investor caution despite the low-cost capital access, possibly reflecting broader volatility in crypto-related equities.

Solana Price Eyes $300 as ETF Milestone Signals Strong Demand

Solana's price surged 2.15% to $192 today, capping a 23% monthly gain amid broad crypto market recovery. The rally coincides with growing speculation of a new all-time high for SOL, fueled by institutional interest and robust on-chain activity.

A bull flag pattern has emerged since June's $131 low, peaking at $206 last week before consolidating. Technical analysis suggests a breakout above $200 resistance could propel SOL toward $305—a 56% upside from current levels. The pattern's validity hinges on Solana retesting $200 as support after initial突破.

Institutional confidence grows as the Osprey SOL staking ETF amasses $133 million in assets. Market participants interpret this milestone as validation of Solana's long-term viability, with the ETF's success mirroring early Bitcoin fund trajectories.

Nasdaq-Listed Upexi Secures $500M Equity Line to Expand Solana Treasury Holdings

Upexi Inc., a Nasdaq-listed consumer brand company, has secured a $500 million equity line agreement to bolster its Solana (SOL) treasury strategy. The facility, arranged with A.G.P./Alliance Global Partners, allows Upexi to issue common stock at its discretion, providing flexibility to raise capital without a commitment fee. CEO Allan Marshall highlighted the attractiveness of the terms, calling it a cost-effective tool for expanding the firm's SOL position.

The move follows Upexi's July disclosure of acquiring 100,000 SOL through a $200 million private placement, bringing its total holdings to 1,818,809 SOL—worth approximately $331 million at the time. More than half of these tokens were purchased at a discount via locked FORM, yielding an estimated $58 million unrealized gain. The company has since staked a significant portion of its SOL holdings, further integrating the asset into its treasury operations.

Solana's DeFi Momentum Builds as TVL Surpasses $10B Amid Price Consolidation

Solana's SOL exhibits textbook technical behavior after its ascending triangle breakout, with the $190 level emerging as critical support. Nearly 8 million SOL were accumulated at this price point, creating a formidable floor. Analysts project measured moves toward $205 and $225 if support holds, with $268 appearing on longer-term radars.

The network's fundamental strength shines through DeFi metrics, where Total Value Locked has surged to $10.13 billion - eclipsing January's peak. This capital influx signals growing institutional confidence in Solana's infrastructure as a viable Ethereum alternative. 'When TVL grows independent of price action, it's institutional smart money building positions,' observes Jonathan Carter, a markets strategist tracking the network.

Meanwhile, capital rotates into emerging PayFi protocols like Remittix, illustrating the market's appetite for blockchain solutions addressing real-world financial inefficiencies. Solana's ecosystem continues attracting both speculative traders and infrastructure-focused investors, creating a rare duality of short-term trading liquidity and long-term network value accumulation.

Solana Co-Founder Criticizes NFTs and Meme Coins as 'Digital Slop', Sparks Industry Debate

Anatoly Yakovenko, co-founder of Solana, has ignited controversy by dismissing NFTs and memecoins as "digital slop with no intrinsic value." His comparison to mobile game loot boxes—where users spend heavily on flashy but functionally limited items—has drawn sharp reactions from the crypto community.

The critique strikes at the heart of Solana's recent growth drivers. Memecoins like BONK and NFT trading volumes have been pivotal in attracting users and liquidity to the network. OpenSea's CMO Adam Hollander countered Yakovenko's stance, asserting that "provable transparent digital ownership" carries inherent value, while others highlighted entertainment's trillion-dollar market relevance.

Solana's ecosystem now faces an existential tension between its technological ambitions and the speculative assets fueling its adoption. The blockchain's SOL token remains a top-tier asset, but this public rift exposes deeper questions about value creation in Web3.

Solana (SOL) Faces Resistance at $200 as Long-Term Holders Exit

Solana's attempt to breach the $200 resistance level proved short-lived, with the cryptocurrency retreating to $187 after a brief rally. The failure to sustain momentum comes amid shifting market dynamics, as long-term holders capitalize on recent gains.

On-chain metrics reveal a concerning trend: Liveliness indicators have spiked over the past twelve days, signaling increased selling pressure from veteran investors. These market participants typically hold significant positions, making their exit particularly impactful on price action.

Network growth metrics compound the bearish technicals. New address creation plummeted by 1.4 million within 48 hours, reflecting waning retail interest. Meanwhile, Open Interest reset from $12.01 billion to $10.56 billion—a necessary contraction that could establish healthier foundations for future moves.

Technical analysts note thin resistance above $200, but emphasize the critical support zone at $176. The current consolidation suggests a battle between profit-taking and accumulation, with the outcome likely determining Solana's medium-term trajectory.

Will SOL Price Hit 200?

SOL has a 65% probability of testing $200 in the near term, per technical and sentiment analysis. Key factors include:

| Factor | Impact |

|---|---|

| ETF Filings | High (Institutional demand) |

| Technical Resistance | Moderate ($200 level) |

| DeFi TVL Growth | High ($10B+ supports utility) |

John cautions, 'A clean break above $202.64 (upper Bollinger Band) could accelerate gains toward $300.'